The Four Pillars of Sustainable Expansion

“The pace of change today is the slowest it will ever be. If you’re not adapting, you’re already behind.”

Most growth playbooks tell you to “hustle harder,” but that’s like flooring the gas pedal with a broken transmission. At Bootstrap Buffalo, we believe that before you accelerate, you need to make sure you are addressing the right constraint. Sustainable, capital-efficient growth starts with getting the fundamentals right built on four foundational pillars:

Revenue

Customer

Cost

Capital

Each of these pillars represents a critical dimension of business health. If even one is misaligned, the entire structure weakens. Get all four aligned, and you create a self-funded, resilient, and scalable enterprise.

What does it mean to be capital-free?

Being “capital-free” doesn’t mean you avoid funding or operate without money, it means capital doesn’t control your decisions.

At Bootstrap Buffalo, we live by the mantra: “Capital is a catalyst, not a crutch.” Too often, businesses throw money at problems hiring prematurely, overspending on tools, or chasing growth before they’ve built the systems to sustain it.

To be capital-free is to stay clear-headed and disciplined, to use capital as a tool for acceleration, not a substitute for strategy. It means building a business that can thrive on its own terms, with or without external funding.

Defining the Four Pillars

Revenue

Building Predictable Income Streams

Revenue is not money coming into your business. True revenue health means generating profitable, predictable, and loyalty-driven income. Rather than chasing one-time sales or quick fixes, a sustainable revenue pillar prioritizes long-term value through recurring subscriptions, contracts, or consistent repeat business. Strong revenue streams reflect customer trust and satisfaction, not just aggressive sales tactics.

Key Question: Are your current revenue streams predictable, scalable, and loyalty-driven, or just temporary bursts of cash?

Customer

Aligning Your Offering with the Right Market

Not all revenue is good revenue, and not all customers are the right customers. The customer pillar emphasizes aligning your solutions with buyers who derive the greatest value from your offering, are willing to pay appropriately for that value, and fit strategically with your brand and business model. Proper customer alignment enhances retention, reduces operational strain, and leads to profitable growth through word-of-mouth referrals and advocacy.

Key Question: Are you serving customers who value your product deeply, pay willingly, and actively promote your brand?

Cost

Operational Efficiency and Waste Elimination

Costs aren’t merely expenses; they represent your ongoing investments into delivering value. However, unchecked or hidden operational inefficiencies can silently erode profitability. Sustainable cost management doesn't mean blindly cutting budgets, it requires rigorously assessing every expense for its contribution to customer value. Operational efficiency involves automating redundant tasks, removing unnecessary complexity, renegotiating vendor contracts, and continually refining processes to free resources that can then be reinvested into growth.

Key Question: Are your operational costs directly tied to delivering customer value, or are hidden inefficiencies quietly draining your profits?

Capital

Strategic Deployment of Funds for Acceleration

Capital, whether from investors or strategic sources, is a powerful tool, but only when used at the right time and in the right context. The capital pillar involves understanding when your business genuinely requires external investment and how best to deploy those funds to accelerate a proven, validated business model. Premature fundraising often dilutes ownership and creates distractions, while strategic, timely capital can dramatically amplify your success.

Key Question: Have you validated your business model sufficiently to ensure external capital will accelerate growth rather than mask foundational problems?

Why These Pillars Matter: Avoiding Costly Misdiagnoses

Many businesses rush towards growth without clearly diagnosing their true constraints. They chase superficial metrics, revenue without recurring stability, customers without strategic fit, operational spending without oversight, and capital as a universal remedy. These missteps are costly, often leading to compromised brand reputation, deteriorating profitability, wasted resources, and diluted equity.

By contrast, correctly diagnosing and systematically addressing the right pillar unlocks genuine momentum:

- Revenue-focused teams shift their attention to loyalty-driven strategies, increasing lifetime customer value.

- Customer-focused teams carefully target ideal segments, improving retention and reducing churn.

- Cost-conscious teams streamline operations, enabling reinvestment into growth initiatives.

- Capital-savvy teams raise funds selectively, amplifying validated success without sacrificing control.

Your Roadmap for Sustainable Expansion

The Bootstrap Buffalo methodology provides a structured diagnostic framework and actionable tools for each pillar. Throughout this guide, you'll find exercises, metrics, checklists, and templates designed to help you pinpoint your real constraints and address them methodically.

Sustainable expansion isn’t achieved through shortcuts; it requires balance, clarity, and discipline. As you progress, remember:

- Revenue must be rooted in loyalty and repeatability.

- Customer alignment must drive both profitability and referrals.

- Costs must be rigorously tied to value creation.

- Capital should amplify proven growth NOT rescue flawed models.

By clearly defining and consistently aligning these four pillars, you won't just build a business that survives you’ll build one that thrives, adapts, and scales sustainably.

Pillar 1: Revenue

Building a Sustainable, Predictable Revenue Engine

“If you can’t trace your revenue to recurring customer value, you don’t have a business you have a transaction log.”

Revenue often feels like success, but without a durable foundation, it's just a mirage. Sustainable growth demands a predictable, repeatable revenue stream deeply rooted in customer loyalty.

Why Revenue Alone Isn’t Enough

Revenue is crucial, but not all revenue is created equal. Businesses frequently mistake short-term gains for lasting growth. Chasing immediate revenue spikes without strategic foundations creates long-term problems, including eroded brand value, customer churn, and shrinking margins.

Common Revenue Traps

One-time Deals: Large sales that boost short-term revenue but leave no recurring pipeline.

Deep Discounts: Aggressive price cuts that secure deals today but destroy long-term margins.

Misaligned Partnerships: Partnerships that drive immediate volume but compromise brand positioning or profitability.

Over-customized Deals: Heavily tailored deals that generate immediate revenue but cannot be replicated at scale, leaving no foundation for sustainable, predictable growth

How to Create Sustainable Revenue

To avoid these pitfalls, Bootstrap Buffalo recommends building a robust revenue model anchored by three foundational pillars:

Recurring Revenue

Focus on subscriptions, annual contracts, maintenance agreements, or repeat-purchase models that generate predictable, ongoing income.

Types of Subscription Models

Subscription models are diverse and can be tailored to fit various business needs:

Fixed or Flat-Rate Pricing: Customers pay a consistent fee for access to a product or service.

Per-User Pricing: Charges are based on the number of users or seats.

Tiered Pricing: Offers multiple packages with varying features and prices.

Usage-Based Pricing: Customers are billed based on their usage levels.

Freemium Models: Basic services are free, with charges for premium features.

Each model has its advantages and can be selected based on

the target market and product offerings.

Understanding Recurring Revenue

Recurring revenue refers to the portion of a company's revenue that is expected to continue in the future. This includes income from subscriptions, annual contracts, maintenance agreements, or repeat-purchase models that generate predictable, ongoing income.

Monthly Subscriptions vs. Annual Contracts

Monthly Subscriptions:

- Customer Perception: Aligns with regular expenses like utilities, making it a habitual payment.

- Product Stickiness: Demonstrates ongoing value and necessity.

- Flexibility: Allows customers to adjust or cancel services easily, which can be both a pro and a con.

- Feedback

Loop: Can provide frequent insights into customer satisfaction and

product performance.

Annual Contracts:

- Revenue Predictability: Secures income for a longer period.

- Customer Commitment: Indicates a higher level of customer trust and commitment.

- Discount Incentives: Often includes discounts to encourage longer commitments.

- Renewal Challenges: Can lead to significant churn if not managed properly at the end of the term.

Why Monthly Subscriptions Often Win

While annual contracts can secure revenue upfront, monthly subscriptions are proof. They prove your product is sticky. They prove that, every month, customers choose you again. More importantly, they show that you’re providing consistent value, without needing to lock someone in.

In today’s market, trust and flexibility matter. The subscription model doesn’t just spread revenue over time, it turns your business into a living system of feedback, engagement, and retention. And that, more than any upfront deal, is the foundation of resilient growth.

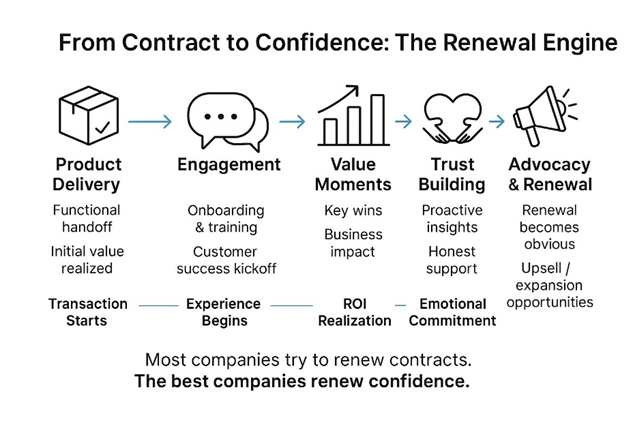

The Complexity of Renewals

Renewals are essential to maintaining recurring revenue, but they’re rarely easy. In fact, keeping customers long-term often proves harder than winning them in the first place.

While customer acquisition gets the headlines, customer retention is where real sustainability is built. But it’s also where companies encounter some of their greatest challenges:

- Churn Rates: The average churn rate for B2B SaaS companies in 2025 is 3.5%, with voluntary churn at 2.6% and involuntary churn at 0.8%. (Source)

- Customer Success Efforts: Dedicated teams work to ensure customer satisfaction and address issues proactively.

- Negotiation Fatigue: Frequent renegotiations can strain resources and relationships.

- Value Demonstration: Continuous proof of value is necessary to justify renewals

Effective renewal strategies involve proactive engagement, understanding customer needs, and delivering consistent value.

- Customer Success Complexity: Entire departments now exist to ensure that customers continue to receive value. Success teams must proactively engage, solve issues, and reinforce ROI, constantly.

- Negotiation Fatigue: Without strong systems in place, companies find themselves repeatedly chasing down renewals, often renegotiating the same terms or offering last-minute discounts just to keep customers from walking.

- Value Demonstration Pressure: If your value isn’t continuously visible, customers begin to question whether they need you at all. The clock resets every billing cycle.

The hidden cost of poor renewal strategies? Internal teams spend so much time “reselling” existing customers that it becomes a drain on growth capacity. Instead of scaling, you’re stuck redefending. The most successful companies build proactive systems that earn renewals through relationship, trust, and consistent results, not reactive effort.

At the end of the day, relationships always win.

Technology evolves. Budgets shift. Needs change. But if your customers trust that you understand them, care about their outcomes, and consistently deliver not just software, but partnership, they’ll choose you again and again.

You’re not just renewing a contract. You’re renewing confidence.

Maintenance Agreements: Proactive Value Delivery

A maintenance agreement isn’t just about fixing things when they break, it’s about preventing failure altogether. It’s a strategic promise: we’ll keep this running, reliably and intelligently.

The most effective maintenance agreements are built around proactive value:

- Preventive Measures: Scheduled service, updates, and inspections to catch wear and tear before it becomes a problem.

- Predictive Maintenance: Leveraging data to identify issues before they occur, minimizing downtime and maximizing customer trust.

- Demonstrated Reliability: Shows the customer that you’re invested in their long-term success, not just emergency responses.

A great analogy is automotive service contracts. Modern vehicles are equipped with smart technology that predicts maintenance needs before the driver even notices a problem. A dashboard alert pops up: “Brake pads need service in 300 miles.” The system is constantly monitoring performance and wear, helping the owner avoid breakdowns through intelligent, timely intervention.

This same principle applies to your business: your systems should know when something is going to go wrong, before the customer does. The result is a powerful shift from reactive support to strategic partnership.

But there’s a paradox: the better you are at preventing issues, the less visible your value becomes. That’s why it’s essential to maintain warm, trusted relationships, with regular touchpoints and proof of performance.

The best maintenance agreements don’t just keep things

running, they keep customers feeling supported, safe, and seen.

Bootstrap Blueprint Tangent: Retention Is What You Do After the Sale

I drive a Ford truck. Bought it new. Great vehicle overall, except for one ongoing issue: the battery kept dying. I had it replaced multiple times. Electrical problems would show up at the worst moments. At one point, I genuinely considered walking away from the brand.

But then something happened that changed my perspective.

Without me asking, Ford pushed a software update that throttled remote features when the truck was parked and offline. The result? Less battery drain, better performance, and most importantly, no trip to the dealership.

No recall. No support ticket. Just a quiet fix that prevented a frustrating experience from becoming a deal breaker.

That’s what real retention looks like.

It wasn’t flashy. It was thoughtful. And it reinforced a sense of trust that Ford had my back, even after the sale was complete.

Here’s the insight:

Retention isn’t about last-minute renewal emails or begging for one more chance.

It’s about building systems that solve problems before they become reasons to leave.

This is the new model of retention, especially in AI-native and platform-driven businesses.

The smartest companies use a three-part diagnostic lens:

- Software Fix – Can we patch or throttle functionality to improve the experience?

- Hardware Fix – Is the problem rooted in physical limitations that need replacement or redesign?

- System Adjustment – Can we reconfigure the environment, usage patterns, or feedback loops to prevent recurrence?

In Ford’s case, a smart software update avoided a costly recall, protected their reputation, and preserved a customer.

Retention isn’t just customer success, it’s operational foresight.

And when done right, it’s the most capital-efficient revenue driver in your entire business.

Importance of Predictable Income

Predictable income from recurring revenue streams offers several benefits:

- Reduced Customer Acquisition Costs (CAC): Retaining customers is often more cost-effective than acquiring new ones.

- Financial Stability: Provides a steady cash flow, aiding in budgeting and forecasting.

- Investor Confidence: Demonstrates a sustainable business model, attracting potential investors.

- Operational Efficiency: Allows for better resource planning and allocation.

In summary, focusing on recurring revenue through subscriptions, proactive maintenance, and effective renewal strategies is essential for building a resilient and scalable business.

Customer Advocacy Loops

Retention isn’t the end of the customer journey, it’s the beginning of the next growth cycle.

Customer advocacy loops transform satisfied customers into active drivers of new business. These loops aren’t accidental. They’re designed intentionally to amplify word-of-mouth, build social proof, and close the trust gap for future buyers.

An effective advocacy loop includes:

- Referral Programs: Incentivize introductions to new leads by rewarding customers who bring in peers or partners.

- Testimonial Pipelines: Make it easy and rewarding for customers to share success stories through videos, quotes, or case studies.

- Reference Networks: Create structured opportunities for prospects to speak with happy customers during sales cycles.

- Community Building: Foster spaces, forums, events, and Slack groups where your customers can share ideas, celebrate wins, and connect with your team.

Here’s the key: advocacy loops only work when your product delivers real, repeatable value. You can't manufacture advocacy from a leaky system.

But when trust is earned and nurtured, advocacy becomes a self-reinforcing engine, feeding new leads into the top of the funnel at a fraction of your traditional acquisition cost.

Full Funnel Visibility

Track every stage of your customer journey: from initial awareness and activation to retention, expansion ARR, and churn rates. Visibility allows for predictable and scalable growth. From Visibility to Revenue: Designing Predictable, Expandable Income

Revenue isn’t just money coming in. It’s the outcome of a system:

One that starts with visibility and ends with value delivered—again and again.

Most startups think they have a revenue problem when what they really have is a visibility gap. They don’t know where the friction is in their customer journey, where dollars are being left on the table, or where churn is quietly draining momentum.

That’s why full funnel visibility isn’t just about dashboards. It’s about building a revenue engine that’s stable, scalable, and deeply aware of itself.

How Each Stage Impacts Revenue

Let’s break it down:

1. Awareness → Top of Funnel Efficiency

If you can’t see where your best leads are coming from, you’ll waste money on acquisition. Visibility here reduces CAC (Customer Acquisition Cost) and sharpens targeting.

Revenue Impact: Lower spend per deal, higher qualified lead flow.

2. Activation → Conversion Confidence

When new users stall or drop off during onboarding, you’re leaking revenue before it ever lands.

Revenue Impact: Improved trial-to-paid conversions = more dollars from the same pipeline.

3. Value Realization → Stickiness and Retention

If customers don’t reach consistent value quickly, they won’t stay. You’ll constantly be refilling a leaky bucket.

Revenue Impact: Faster time-to-value → higher retention → reduced churn costs.

4. Retention → Baseline Stability

The longer you keep a customer, the more profitable they become. Retention isn’t just a metric—it’s recurring revenue’s foundation.

Revenue Impact: Increases LTV (Lifetime Value), flattens volatility.

5. Expansion ARR → Revenue Growth Without Acquisition

The most capital-efficient revenue is the kind that comes from your existing base. When you track product usage, seat growth, and feature adoption, you unlock expansion.

Revenue Impact: Boosts NRR (Net Revenue Retention) and drives growth without new headcount or CAC.

6. Churn → Revenue Defense

Understanding churn allows you to forecast and prevent revenue loss before it happens. Churn isn’t just a loss—it’s a signal.

Revenue Impact: Reduces revenue volatility and increases predictability.

Metrics That Power Revenue Strategy

|

Metric |

What It Tells You |

Revenue Implication |

|

DAU/WAU |

Are users active and engaged? |

Signals usage-based expansion potential |

|

PQL |

Has the user reached value? |

Warmer conversion = higher close rates |

|

NPS/CSAT |

Are customers satisfied? |

Predicts referrals and churn risk |

|

NRR |

Are we growing from existing customers? |

Core KPI for sustainable B2B SaaS revenue |

|

Churn Rate |

Who’s leaving, and why? |

Direct hit to ARR and growth compounding |

|

Expansion ARR |

How much upsell is happening? |

Drives revenue growth without acquisition costs |

The Blueprint Mindset

You don’t grow revenue by pushing harder.

You grow it by seeing the system, removing the friction, and reinforcing what works.

Every part of your funnel is either generating, protecting, or leaking revenue.

Visibility isn’t just helpful, it’s how you move from random bursts of income to measurable, recurring streams.

This is what powers real, capital-efficient growth:

Not just more customers but the right ones, staying longer, expanding faster, and telling others.

Real-World Example: Amazon’s Flywheel Model

Amazon famously embraced a strategy of investing heavily in its Prime subscription service, even at initially thin margins. Prime customers, drawn by free shipping and added services, became extremely loyal, significantly boosting their lifetime spend. Over time, Amazon built predictable recurring revenue, enabling massive reinvestment into the business.

The lesson: prioritize loyalty-driven revenue streams, even if initial returns seem modest, because compounding returns from repeat customers ultimately fuel substantial growth.

Creating a Customer-Centric Revenue Model

If you want sustainable revenue, you can’t just focus on collecting payments.

You have to build a model that delivers value and proves that value at every layer of your business.

A customer-centric revenue model starts with one question:

“Are we building something people want to stay part of?”

It’s not just about product or pricing. It’s about designing every decision, from roadmap to renewals, to reinforce trust and long-term value. That means zooming out from pure monetization and evaluating impact across three layers:

Me. We. Them.

A simple but powerful lens for evaluating your revenue strategy:

1. Me: Internal Business Needs

This is your operational reality, your need to generate revenue, protect margins, and stay solvent.

Ask:

- Is this pricing model profitable?

- Can we deliver this with consistent quality at scale?

- Are we spending more to keep a customer than we earn from them?

This is the engine of your business. But it can’t be the only lens.

2. We: Customer Alignment

This layer is about the direct relationship with your customer. If they don’t see your product as essential, they won’t stick around—no matter how clever your pricing is.

Ask:

- Does this model reinforce trust and transparency?

- Is the pricing structure intuitive and fair from the customer’s perspective?

- Are we making it easier for them to succeed, expand, and advocate?

This is your retention layer—where renewals, referrals, and advocacy begin.

3. Them: Community & Ecosystem Impact

Beyond the transaction, your revenue model affects the broader ecosystem: partners, industry perception, and long-term brand equity.

Ask:

- Are we contributing positively to the markets and communities we serve?

- Does our business model encourage ethical behavior, accessibility, or inclusion?

- Will our decisions today build trust in the brand tomorrow?

This is the reputation layer—and often the biggest driver of long-term growth and resilience.

Why This Matters

A model that maximizes "Me" at the expense of "We" creates churn.

A model that maximizes "We" but ignores "Me" burns out and breaks.

And one that forgets "Them" risks becoming irrelevant or resented over time.

Sustainable revenue comes from alignment, not just acquisition.

It's when what’s good for the customer is also good for the business, and good for the world around it.

In a world driven by AI, automation, and optimization, the most competitive companies will be the ones that earn loyalty through design, not just marketing.

Key Principles

Long-Term Value Over Short-Term Gains: Prioritize recurring and renewable customer relationships.

High-Value Offerings Aligned to Customer Needs: Develop services/products specifically crafted to solve high-value customer pain points.

Community Impact and Brand Integrity: Align business practices with broader community values to foster deeper customer loyalty.

Creating a Scalable Revenue Engine: Step-by-Step Approach

Once you've validated product-market fit and profitability, shift focus to creating predictable and scalable revenue generation:

Step 1: Optimize Customer Acquisition and Activation

- Identify high-value segments with higher lifetime value (LTV) and lower customer acquisition costs (CAC).

- Deploy referral programs, targeted digital campaigns, and automation to streamline and scale without excessive cost.

Step 2: Control Delivery and Renewal Costs

- Implement operational efficiencies and automation to manage increased customer volumes without proportional growth in overhead.

- Leverage technology to reduce manual renewal efforts and improve customer retention rates.

Step 3: Build Strategic Partnerships

- Collaborate with partners who have access to your ideal customer segments.

- Leverage co-marketing, co-branding, or joint distribution opportunities to accelerate growth efficiently.

Strategic Roadmap: Avoiding Unsustainable Tactics

Avoid shortcuts that appear attractive in the short term but risk long-term brand health and profitability. Common quick-fix pitfalls include:

- Aggressive discounting without considering margin impact.

- Unaligned partnerships that dilute brand strength or credibility.

- Upselling tactics that prioritize short-term revenue over customer trust and long-term relationship value.

Instead, pursue sustainable practices that align with brand integrity, customer loyalty, and long-term profitability. For instance, businesses investing in ethical practices and community engagement often see these initiatives translate into robust customer loyalty and long-term revenue stability.

Conclusion: Revenue as a Foundation of Sustainable Growth

Revenue is vital but only sustainable, repeatable, and customer-centric revenue leads to long-term success. By prioritizing recurring income, loyal advocates, and strategic scalability, your revenue pillar will provide a robust foundation upon which all other aspects of your business can flourish.

The Bootstrap Buffalo approach guides you in structuring your revenue streams carefully, ensuring that every decision aligns with customer satisfaction, cost control, and long-term growth.