What Does It Really Mean to Be Capital-Free?

People keep asking me:

“What does capital-free really mean?”

Some assume it means running your business without raising money, avoiding loans, or offering equity instead of salaries. But that’s not quite it.

At Bootstrap Buffalo, being capital-free isn’t about avoiding capital, it’s about not being controlled by it.

It means capital isn’t your constraint. It’s not the thing holding you back from launching, growing, or adapting. It’s not dictating your timeline, your priorities, or your peace of mind.

Being capital-free is about building from strength, not scarcity.

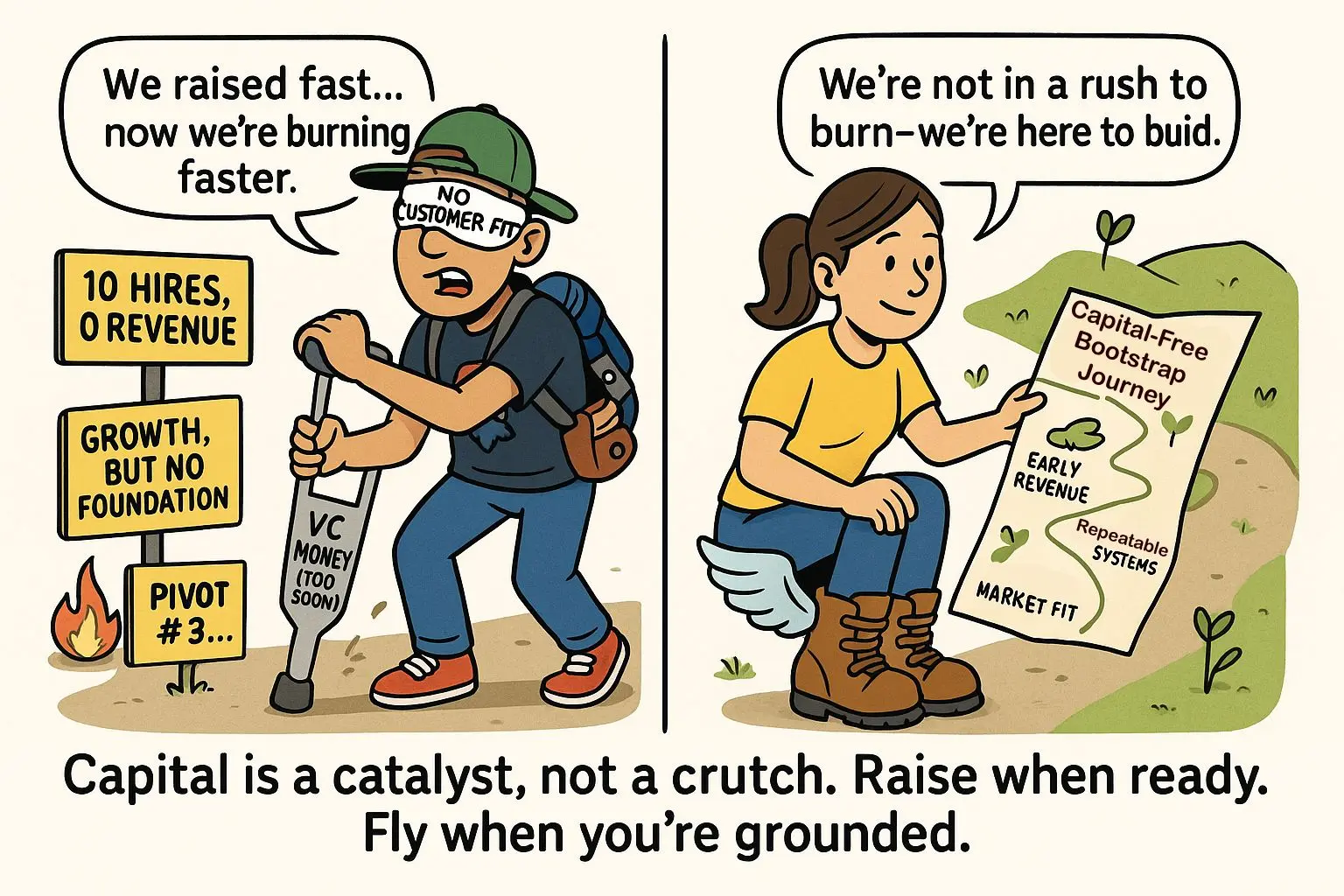

It’s about designing a business that uses capital as a catalyst, not a crutch.

It means:

- You don’t need permission to start.

- You don’t scale recklessly just because funding showed up.

- You don’t drown in burn rate panic because your foundation wasn’t ready.

You build with discipline, traction, and clarity, so when the time comes to accelerate, capital amplifies what’s already working.

How Do You Know If Capital Is Actually Your Constraint?

Sometimes founders think they need capital, but what they really need is clarity.

If you can’t clearly articulate what $1 of investment will return, and when, then adding more money is just throwing fuel on a fire you can’t control.

Ask yourself:

- Are your revenue streams predictable and repeatable?

- Do you know your CAC, activation rate, payback period, and margin across the customer lifecycle?

- Can you tie capital directly to strategic execution and measurable return?

If the answers are fuzzy, capital probably isn’t your constraint, it’s just what you’re hoping will save you from unresolved gaps in your model.

So When Is It Time to Raise?

There are plenty of situations where raising capital, or even taking a loan, is the right move:

- You’ve soft-launched and now need to scale go-to-market with a proven funnel.

- You’ve validated a problem and locked in early sponsor customers, and you want to accelerate your technical roadmap to hit a strategic milestone.

- You’re acquiring a business, buying time, or locking in a head start that gives you market advantage.

In those cases, capital isn’t plugging a hole, it’s unlocking momentum.

That’s the key:

You raise from the right sources, at the right time, to accelerate the right things, not just to buy time, or chase growth for growth’s sake.

That’s what being capital-free really means.

You’re not capital-averse. You’re capital-aware. You raise with intention, not out of desperation.